Effective basement waterproofing is important for upholding your home’s structural stability and overall worth. However, many homeowners find themselves questioning whether their insurance policies cover the costs associated with basement waterproofing. This blog post will delve into the intricacies of home insurance, the circumstances under which basement waterproofing might be covered, and provide actionable tips on how to protect your home from water damage.

Must Read: What Sets Patio Waterproofing Solutions Apart From Other Deck Systems?

Table of Contents

ToggleBasement Waterproofing

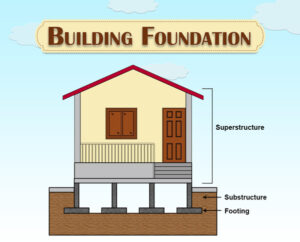

Before exploring the insurance aspect, it’s important to understand what basement waterproofing entails. Basement waterproofing involves a variety of techniques used to prevent water from entering a basement. These methods include:

Interior Waterproofing: It involves handling water that has already seeped into the basement. This might include sump pumps and interior drainage systems.

Exterior Waterproofing: This involves stopping water from getting into the basement in the first place by sealing the foundation from the outside.

Drainage Systems: Effective grading and drainage solutions can redirect water away from your home’s foundation.

Types of Water Damage Included in Home Insurance Coverage

Home insurance policies generally cover water damage, but the specifics can vary widely between policies and providers. The key is to understand the different types of water damage that insurance might cover:

Sudden and Accidental Damage: Most standard home insurance policies cover sudden and accidental water damage, such as damage caused by a burst pipe or an appliance malfunction.

Flood Damage: Flood damage is typically not covered by standard home insurance policies. Homeowners living in areas susceptible to flooding typically need to acquire separate flood insurance.

Gradual Damage: Damage that arises from neglect or maintenance issues over time is typically not included in standard insurance policies.

When Is Basement Waterproofing Covered?

Sudden and Accidental Damage: If your basement floods due to a sudden event like a burst pipe, your insurance might cover the resulting water damage. However, the cost of waterproofing the basement to prevent future incidents is unlikely to be covered.

Flood Insurance: If you have a flood insurance policy, it might cover the costs associated with repairing water damage from flooding. However, flood insurance typically does not cover preventative measures such as basement waterproofing.

Endorsements and Riders: Some insurance policies offer endorsements or riders that provide additional coverage for water damage. This could potentially include some forms of basement waterproofing. Be sure to consult with your insurance provider about these options.

Steps to Take When Your Basement Floods

Document the Damage: Immediately take photos and videos of any damage you find. This documentation will be crucial for processing your insurance claim.

Contact Your Insurance Provider: Report the damage to your insurance company without delay. They will guide you through the claims process and inform you of any steps you need to take.

Mitigate Further Damage: Take immediate steps to prevent further damage, such as shutting off the water supply if a pipe has burst or using a sump pump to remove standing water.

Hire Professionals: Hire a certified water damage restoration service to evaluate the extent of the damage and initiate the cleanup process.

Protecting Your Basement from Water Damage: Essential Strategies

Although your insurance policy may cover water damage, the best strategy is to prevent it from happening in the first place. Here are some tips for protecting your basement from water damage:

Maintain Your Gutters and Downspouts: Ensure that your gutters and downspouts are clear of debris and direct water away from your home’s foundation.

Install a Sump Pump: A sump pump can assist in draining excess water that gathers in your basement. Consider installing a battery backup in case of a power outage.

Seal Cracks in Your Foundation: Inspect your foundation regularly for cracks and seal them to prevent water from entering your basement.

Proper Grading: Ensure that the ground around your home slopes away from the foundation to prevent water from pooling near your home.

Install Window Well Covers: If your basement has windows at or below ground level, install window well covers to keep water out.

Common Exclusions in Home Insurance Policies

Understanding common exclusions in home insurance policies can help you avoid unexpected surprises when filing a claim. Some of the most common exclusions related to water damage include:

Neglect: Usually, damage resulting from inadequate maintenance or neglect is not covered. For example, if a homeowner fails to repair a known leak and it leads to extensive water damage, the insurance claim might be denied.

Wear and Tear: Damage that occurs gradually over time due to wear and tear is typically excluded. This includes issues like slow leaks or deteriorating pipes.

Mold: Mold resulting from water damage is often excluded or has limited coverage. Some policies may offer a small amount of coverage for mold remediation, but it is often not enough to cover extensive mold damage.

Flooding: Standard home insurance policies typically exclude flood damage coverage. Homeowners residing in areas prone to flooding should acquire separate flood insurance to ensure protection.

Tips for Filing a Successful Insurance Claim

Read Your Policy: Review your insurance policy to clearly understand the coverage details and any exclusions. Knowing the details of your policy can help you navigate the claims process more effectively.

Keep Detailed Records: Maintain records of home maintenance and repairs. This documentation can help prove that you have taken steps to maintain your home and mitigate damage.

Work with Professionals: Hire licensed and reputable contractors to handle repairs. Retain all receipts and records about the repairs.

Communicate Clearly: Be clear and concise when communicating with your insurance provider. Provide all necessary documentation and follow their instructions carefully.

| Type of Damage | Covered by Standard Home Insurance | Covered by Flood Insurance | Notes |

|---|---|---|---|

| Sudden & Accidental | Yes | No | Examples include burst pipes and appliance malfunctions. |

| Flood Damage | No | Yes | Separate flood insurance is necessary to cover damage caused by flooding. |

| Gradual Damage | No | No | Includes wear and tear, and neglected maintenance. |

| Sewer Backup | Sometimes (with endorsement) | No | Optional sewer backup endorsements may be available. |

| Mold | Limited | No | Limited coverage, often not enough for extensive remediation. |

Conclusion

Basement waterproofing is a critical component of home maintenance, but it is not typically covered by standard home insurance policies. Understanding the specifics of your insurance coverage, taking preventative measures, and knowing how to file a successful claim can help you protect your home from water damage. Speak to our waterproofing professionals to stay informed and proactive, you can minimize the risk of basement flooding and ensure that you are prepared to handle any water damage that does occur.